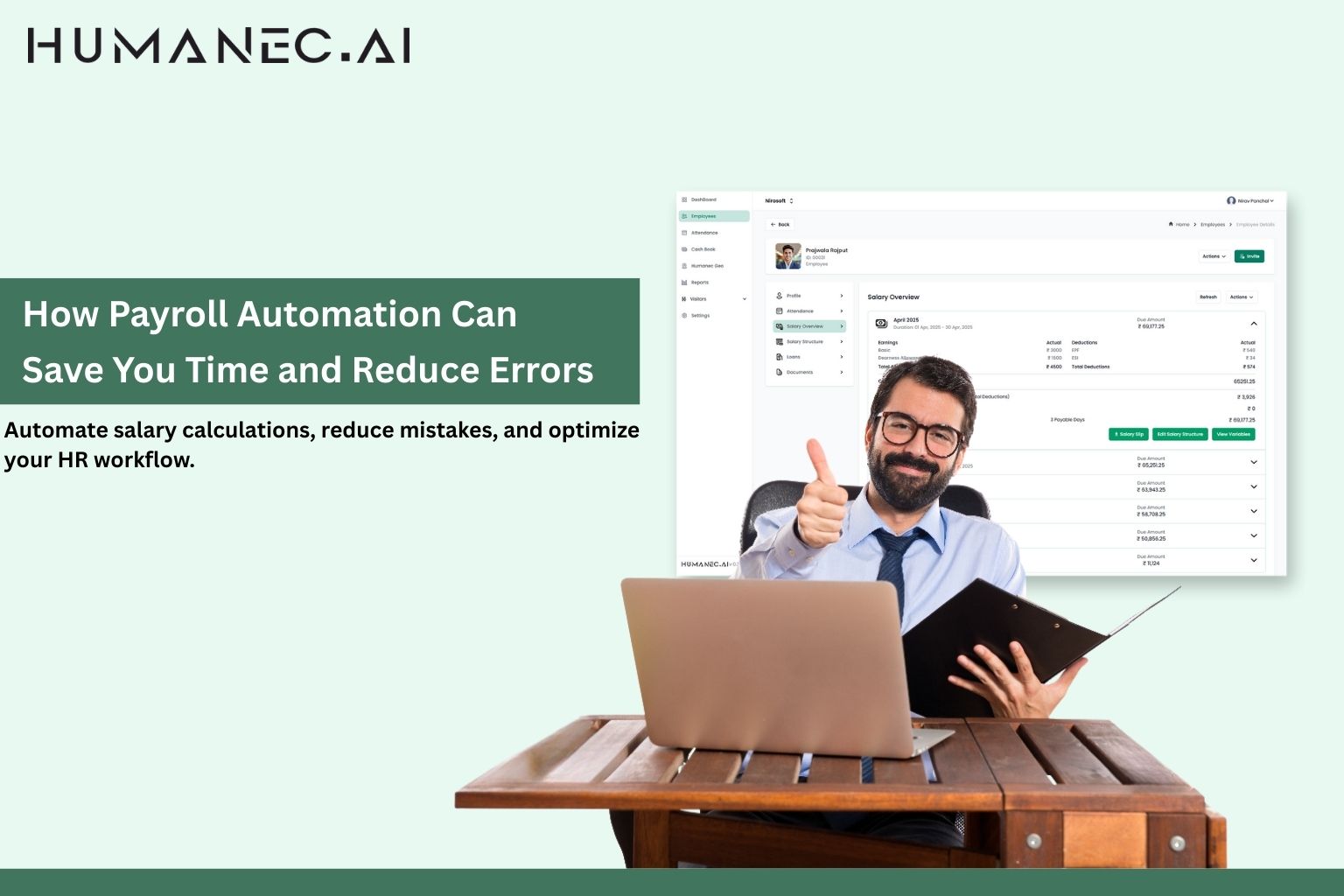

Payroll Automation: How It Can Reduce Errors and Increase Efficiency

Managing payroll manually can be time-consuming, stressful, and often leads to calculation errors — especially for growing businesses in India that must navigate complex compliance requirements, varied salary structures, and diverse employee expectations.

Payroll automation changes the game by streamlining salary processing, ensuring accuracy, and freeing up HR teams to focus on strategic priorities.In this guide, we’ll explore how payroll automation reduces costly mistakes, improves efficiency, and drives better employee satisfaction — plus why Humanec’s solution is the right fit for your business.

What Is Payroll Automation?

Payroll automation is the process of using software to manage payroll tasks — from calculating salaries to deducting taxes and generating payslips — without manual intervention.

With Humanec Payroll Software, businesses can:

- Automatically calculate gross and net salaries.

- Apply PF, ESI, and TDS deductions accurately.

- Sync payroll with attendance and leave data.

- Generate reports for compliance and management in seconds.

The result? A faster, more accurate, and stress-free payroll cycle.

(2).jpg)

Common Payroll Errors & Their Impact

Even small payroll mistakes can lead to financial loss, compliance penalties, and employee dissatisfaction. Common errors include:

- Salary miscalculations due to manual data entry.

- Incorrect overtime or bonus payments.

- Non-compliance with statutory laws, leading to fines.

- Duplicate or missed payments.

Such mistakes not only damage company credibility but also waste HR time on corrections and reconciliations.

How Payroll Automation Reduces Errors

Automation tackles payroll errors at their root cause: manual handling.

1. Eliminates Data Entry Mistakes

Payroll automation pulls employee data directly from attendance and HR systems, reducing the risk of typing errors or outdated records.

2. Automatic Tax & Compliance Updates

Rules for PF, ESI, and TDS change frequently in India. Automated payroll systems update these rules instantly, ensuring full compliance.

3. Prevents Payment Discrepancies

Software checks and validates payment records, ensuring no employee is overpaid, underpaid, or missed during processing.

How Payroll Automation Improves Efficiency

Beyond reducing errors, payroll automation significantly boosts operational efficiency.

1. Faster Payroll Processing

What once took hours or days can now be completed in minutes — especially when payroll is linked to attendance and leave records.

2. Easy Payslip & Report Generation

With one click, HR can generate payslips, compliance reports, and analytics, saving valuable time.

3. Reduced HR Workload

Free from repetitive calculations, HR teams can focus on talent management, engagement, and growth strategies.

Key Features to Look for in Payroll Automation Software

When choosing the best payroll software in India, ensure it offers:

- Cloud-based access for remote management.

- Integration with HRMS, attendance, and leave systems.

- Statutory compliance automation (PF, ESI, TDS).

- Multi-location payroll processing.

- Employee self-service portal for payslips and tax forms.

Humanec Payroll Software delivers all these features — and more.

Why Choose Humanec for Payroll Automation

Humanec is designed for Indian businesses of all sizes, offering:

- 100% compliance readiness with Indian labor laws

- Seamless integrations with attendance and HRMS systems.

- Scalable features for startups, SMEs, and enterprises.

- User-friendly mobile app for payroll on the go.

The Payroll Automation Process with Humanec

- Data Collection – Employee attendance, leave, and salary details are synced automatically.

- Salary Calculation – Gross pay, deductions, and net pay are calculated instantly.

- Tax Compliance – PF, ESI, and TDS deductions are applied as per updated laws.

- Payment Processing – Direct bank transfers to employees.

- Reporting – Instant payslips, compliance documents, and analytics.

Discover how Humanec can transform your HR:

Book a Demo:

Visit WebsiteDownload the Humanec App:

- Android :Download Now

- iOS :Download Now

View Pricing Price:

FAQs

What is payroll automation?

It’s the use of software to handle payroll tasks automatically, from salary calculations to compliance reporting.

How does automation contribute to payroll efficiency?

It speeds up processing, reduces errors, and ensures accurate compliance.

How can payroll efficiency be improved?

By integrating payroll with attendance systems, automating tax deductions, and using cloud-based software.

What is the payroll automation process?

It involves collecting data, calculating pay, applying deductions, making payments, and generating reports — all handled automatically.

Why is it important to have an efficient payroll process?

It saves time, reduces costs, avoids penalties, and boosts employee trust.