How to Automate Payroll Processing for Indian Businesses – Step-by-Step Guide

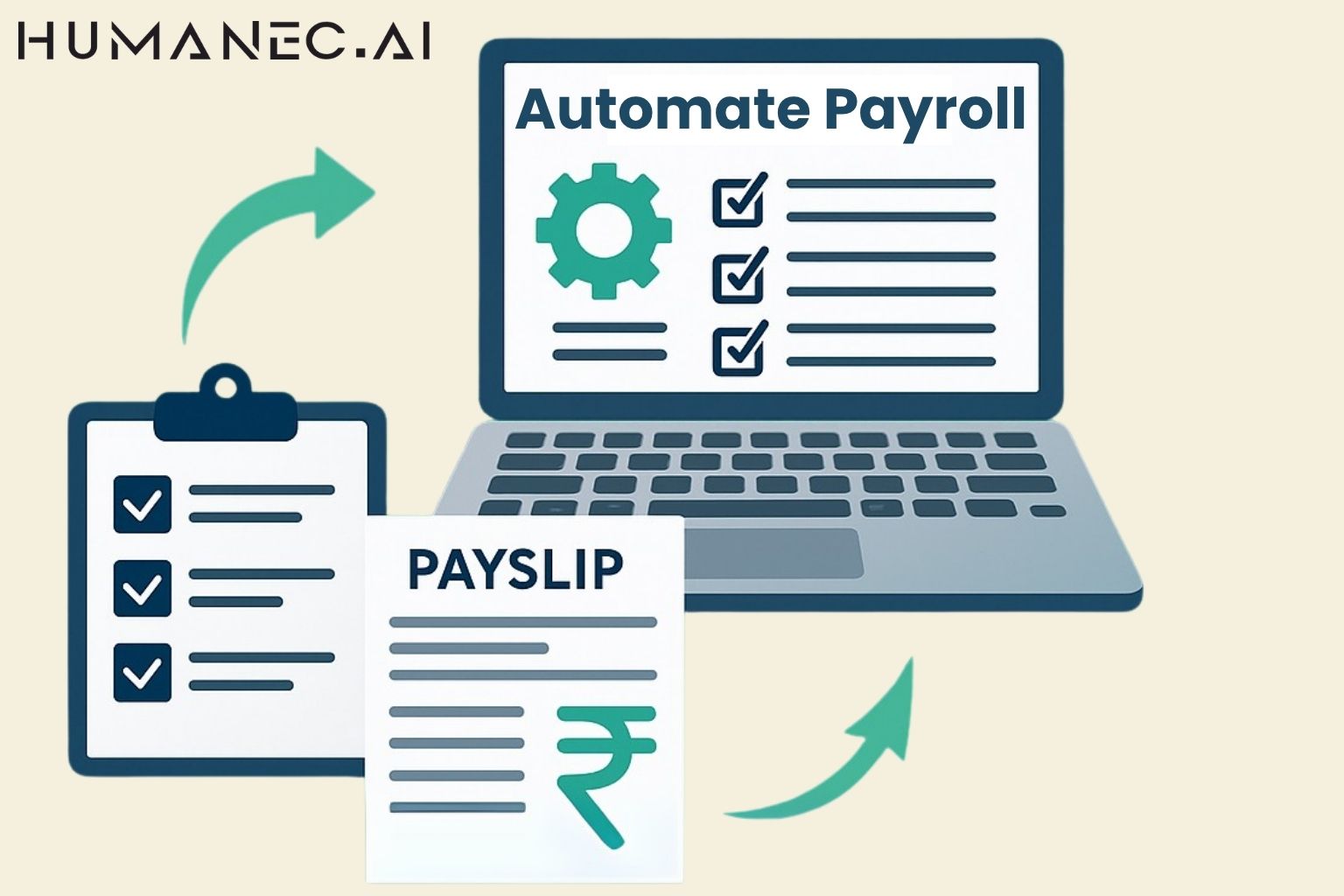

Managing payroll manually is a tedious, error-prone process—especially for growing Indian businesses navigating compliance, tax laws, and dynamic workforce needs. The good news? Payroll automation can transform this administrative burden into a streamlined, compliant, and error-free operation.

In this comprehensive guide, we’ll break down how to automate payroll processing, explain the key stages in the payroll processing process, and help you choose the right payroll software in India for your business.

What is Payroll Processing?

Payroll processing is the step-by-step system of calculating and distributing salaries to employees, deducting statutory and voluntary components like TDS, PF, and ESI, and filing the necessary government reports.

A typical HR payroll process includes:

- Collecting attendance and leave data

- Calculating gross and net pay

- Deductions (PF, TDS, ESI, Professional Tax, etc.)

- Generating payslips

- Transferring salaries to employee bank accounts

- Filing statutory returns (Form 24Q, PF, ESI, etc.)

Why Should You Automate Payroll Processing?

Manual payroll methods are prone to human error, time theft, and non-compliance. Here are a few reasons to automate payroll processing in India:

Accuracy & Compliance

Avoid costly errors in salary calculation

Stay compliant with ever-changing Indian tax laws

Time & Cost Efficiency

Reduce admin hours spent on repetitive payroll tasks

Eliminate the need to hire a full-time payroll executive or CA

Better Record Management

Maintain digital records for auditing and employee references

Scalability

Handle complex structures like multiple shifts, branches, and variable pay

Payroll Processing Steps (Manual vs. Automated)

Let’s compare the key payroll processing steps in manual vs. automated methods:

.jpg)

How to Automate Payroll Processing (Step-by-Step Guide)

Here’s a practical roadmap for Indian SMEs and startups to move from manual to automated payroll processing:

1. Choose the Right Payroll Software

Look for features like:

- Statutory compliance (PF, TDS, ESI, PT)

- Integrated attendance & leave

- Auto payslip generation

- Tax declaration management

2. Set Up Employee Master Data

Import:

- Employee IDs

- Bank details

- PAN, Aadhaar

- Salary structure

- Designation & department

3. Define Payroll Policies

Customize:

- Payroll cycle (monthly, bi-weekly)

- LOP rules

- Overtime policies

- Incentives, bonuses, reimbursements

4. Integrate Attendance & Leaves

Use Humanec’s automated attendance system for real-time syncing of:

- Clock-in/out data

- Leave approvals

- Work-from-home entries

5. Run Monthly Payroll

With everything set, Humanec auto-calculates:

- Gross & net pay

- Deductions

- Incentives

- TDS

- Final salary

6. Generate Payslips & Salary Reports

- Employees receive digital payslips on email or mobile app

- HR/Admin gets downloadable payroll reports

7. Automate Compliance Filing

- Auto-generate challans for PF, ESI, and TDS

- Export returns for upload to government portals

Top Features of Payroll Software in India

When evaluating payroll software for small businesses, ensure the solution includes:

- Salary Slip Generator Software

- Auto TDS & Income Tax calculation

- Bonus & Incentive handling

- Gratuity, LWF, PT calculators

- Audit trail & document storage

- HR reports & dashboards

Humanec – Made for Indian Businesses

Humanec is a comprehensive HRMS and payroll processing software India trusts. It supports:

- Small to mid-sized businesses

- Real-time attendance to salary automation

- Mobile and web access for admins & employees

Conclusion

An automated payroll system isn’t just a digital upgrade — it’s a strategic business asset. From preventing time theft to enabling real-time workforce tracking, it helps you improve compliance, reduce admin workload, and increase operational efficiency.

Make the shift to Humanec and start managing your payroll smarter.

Get Started with Humanec – HRMS Software for Growing Businesses

Transform the way you handle HR with Humanec—fast, simple, and built for scaling teams.

Book a Demo:

Visit WebsiteDownload the Humanec App:

- Android :Download Now

- iOS :Download Now

View Pricing Plans:

FAQs

Which is the best HRMS software in India for small businesses?

Humanec is one of the top hrms software in India designed specifically for small businesses. It offers payroll, attendance, and compliance tools in one affordable platform.

Is HRMS software useful for startups?

Yes. Whether you're a 5-person startup or a 100-employee SME, HRMS software for small business helps streamline processes and save time on repetitive admin tasks.

What is the cheapest HRMS software?

While many options exist, Humanec provides value-based pricing tailored to growing businesses. You get enterprise-grade features without the enterprise price tag.

What is the best HR and payroll software in India?

Humanec combines both HR and payroll in a mobile-first app, making it ideal for Indian SMEs looking for a simple yet powerful solution.

What is the difference between HRMS, HRIS, and HCM?

All are HR software types, but HRMS (like Humanec) usually includes more features such as payroll, attendance, and compliance—ideal for small business operations.